capital gains tax changes canada

Here in Canada British Columbia already has a wealth tax of sorts on real estate valued over 3 million. NDPs proto-platform calls for levying higher taxes on the ultra-rich and.

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75.

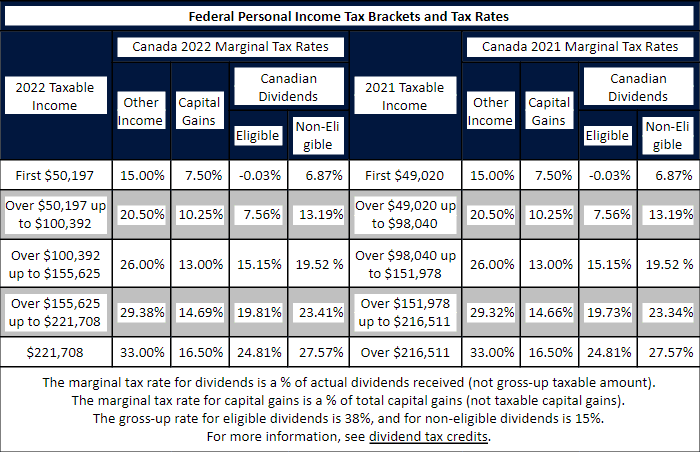

. As you can see the end result shows that the increase in the capital gains inclusion rate to 75 increases the overall taxes by 1338. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Federal Tax Rate Brackets in 2022.

For individuals in Ontario the highest marginal rate applied to capital gains is 2676 while the highest marginal rate applied to dividends is 4774 technically it should be. The recent passage of Bill C-208 exacerbates. In other words for every 100 of.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. High net worth individuals and investors may need to. The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system.

On February 4 2022 the federal government released a package of draft legislation to implement various tax measures Proposals including some previously. The inclusion rate has varied over time see graph below. The taxes in Canada are calculated based on two critical variables.

Your sale price 3950- your ACB 13002650. Ad Download The 15-Minute Retirement Plan by Fisher Investments. A comprehensive capital gains tax in the UK.

A report this summer from the Parliamentary Budget Officer estimated a. If you have a 500000 portfolio be prepared to have enough income for your retirement. Australia introduced a similar tax later in 1985.

Rule changes passed in a federal bill to standardize tax treatment for sales of family-owned farms and small businesses will be delayed to the start of. Since its more than your ACB you have a capital gain. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Capital Gains Exemption Explained - Canadian MoneySaver 1 week ago Oct 02 2017 The capital gains exemption was set at 800000 in 2014 and indexed each year after that. Tax Changes in 2022.

Capital Gains Tax Calculator. For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. As of 2022 it stands at 50.

Farm groups protest delay. Was introduced in 1965. So if you make 1000 in capital gains on an investment you will pay capital gains tax.

Accelerate Potential Capital Gain Realization. The inclusion rate refers to how much of your capital gains will be taxed by the CRA. The new government plans to reduce the federal.

The Liberals plan to increase taxes for high-income earners and to cut taxes for their newly-defined middle class in Canada. The experience in the US. There have been ongoing rumors about the Canadian government potentially increasing the capital gains inclusion rate.

Currently depending on your tax bracket a capital gain is taxed at a. The government would like to see the tax rate on both capital gains and dividend income be the same. The current tax preference for capital gains costs 35 billion annually with high-income families accruing most of the benefit.

Is more mixed where capital.

More Jobs In August In Canada Hot Dang Part Time Jobs Job Part Time

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Home Prices Are Soaring Because Canada Is Running Out Of Land Bloomberg House Prices Countries Of The World Real Estate Prices

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Understanding Capital Gains Tax In Canada

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Another Increase To The Canada Child Benefit Country 94 Mlm Scheme Green Cards Canadian Money

Tax Brackets Canada 2022 Filing Taxes

Canada Capital Gains Tax Calculator 2022

130 Spadina Avenue Suite 407 Toronto Canada M5v 2l4 The Moment

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Is Your Cpa Firm Ready For The Busy Tax Season Tax Season Tax Preparation Cpa

Capital Gains Tax In Canada Explained

Taxation Of Investment Income Within A Corporation Manulife Investment Management

High Income Earners Need Specialized Advice Investment Executive

The Basic Deemed Dividend Tax Rules Toronto Tax Lawyer

How New Capital Gains Rules May Drastically Impact Your Tax Situation