tax benefits of retiring in nevada

Each state has a different mix of tax breaks for retireesmost exempt certain types of retirement income but they tax others. The new 15 percent minimum tax would apply to corporations that report annual income of more than 1 billion to shareholders on their financial statements but use deductions credits and other.

How To Plan For Taxes In Retirement Goodlife Home Loans

Up to 3500 is exempt Colorado.

. A lack of tax. 20000 for those ages 55 to 64. You can add benefits or modify terms before you finalize an annuity contract but a bond indenture cannot be changed.

Today on Insight were looking at what the Inflation Reduction Act means for California the states Supreme Court Chief Justice is retiring this fall and we hear about the Nevada County Film. Although tax-advantaged retirement plans such as 401k accounts are technically deferred compensation plans the term deferred compensation in general use. If youve got questions about the retirement system in Nevada youre not alone most have questions ranging from how benefits are calculated to if the plan benefits.

For many however it can be somewhat confusing and arcane trying to understand what the system is and exactly how it works. Typically you receive deferred compensation after retiring or leaving employment. Annuities also have the advantage of being tax-deferred while bond income is taxable.

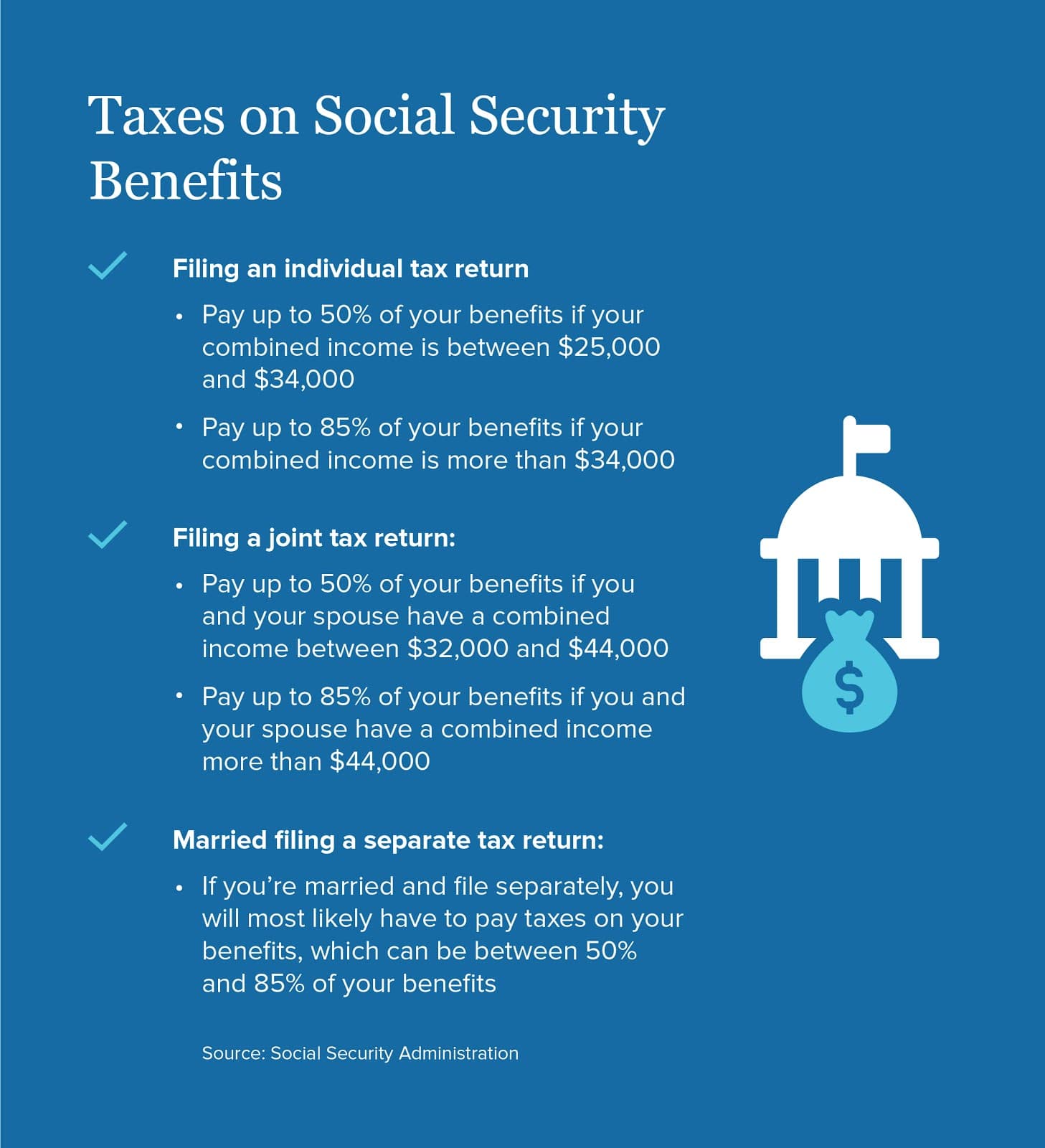

In the long term annuities typically show better rates of return than bonds and annuities tend to hold their carrying value better over time. Deferred compensation refers to money received in one year for work performed in a previous year often many years earlier. Thirty states exempt all Social Security benefits from taxation.

Nine states include Social Security benefits in taxable income but they provide exclusions exemptions and deductions. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state income taxes at all. These 38 states dont have Social Security benefit taxes.

Up to 2000 of retirement income. And 7500 for military retirees under age 55 increasing to 10000 in 2021 and 15000 in 2022 and 2023. Military retirement pay is partially taxed in.

PERS is an important resource for employees of the state in Nevada. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

The following 38 states dont tax the Social Security benefits of any of their residents.

7 Pros And Cons Of Retiring In Nevada 202 Aging Greatly

37 States That Don T Tax Social Security Benefits The Motley Fool

Nevada Retirement Tax Friendliness Smartasset

Nevada Vs California Taxes Explained Retirebetternow Com

The Most Tax Friendly States To Retire

States That Don T Tax Retirement Income Personal Capital

Retire In California Or Nevada Retirebetternow Com

Nevada Retirement Tax Friendliness Smartasset

Will Your Planned Retirement Income Be Enough After Taxes Brady Martz Associates

How To Reduce Taxes In Retirement Accuplan Benefits Services

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Nevada Tax Advantages And Benefits Retirebetternow Com

How To Spend A Day In Scottsdale Az Arizona Road Trip Great Basin National Park Trip

Nevada Retirement Tax Friendliness Smartasset

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

The 10 Best Places To Retire In Nevada In 2021 Newhomesource